Exploring Dutch E-commerce, Part 2: Opportunities for Dutch Sellers to Expand Abroad

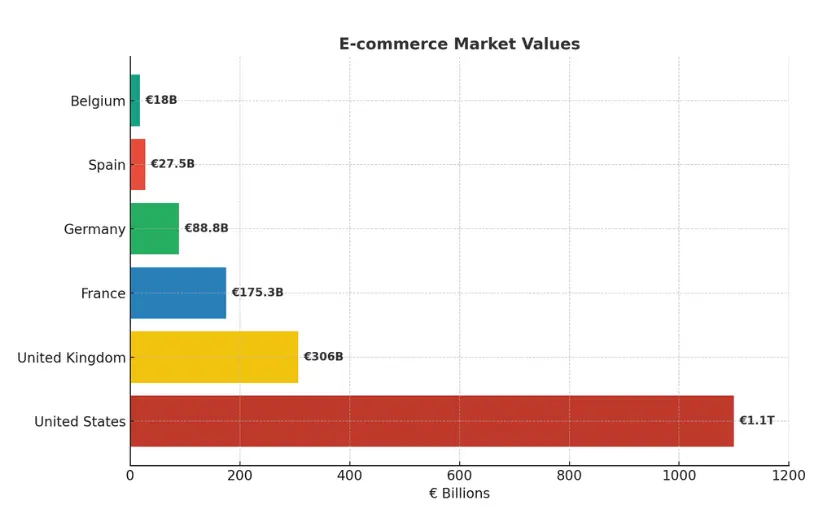

The Netherlands has emerged as one of Europe's most strategic e-commerce export hubs, offering Dutch retailers unprecedented access to six high-value international markets worth over €1.7 trillion combined. With advanced logistics infrastructure, multilingual capabilities, and proven cross-border expertise, Dutch e-commerce businesses are uniquely positioned to capitalize on markets ranging from the neighboring €18 billion Belgian opportunity to the massive €1.1 trillion US market. Understanding the distinct characteristics and consumer behaviors across these markets becomes crucial for successful international expansion.

Recent data reveals that cross-border penetration varies dramatically across target destinations, creating distinct opportunities for Dutch retailers who can adapt their strategies to local preferences.

The Netherlands-Belgium E-commerce Corridor

The Netherlands-Belgium trade relationship represents one of Europe's most successful cross-border e-commerce partnerships, built on decades of logistics collaboration and shared infrastructure. The historical connection through Bpost's extensive network has created unique competitive advantages for Dutch retailers, enabling them to offer same-day and next-day delivery capabilities that rival domestic services.

Belgium's market characteristics make it particularly attractive for Dutch expansion. With 11.3 million online shoppers spending €1,550 annually and 32% of e-commerce consisting of cross-border purchases, Belgian consumers demonstrate sophisticated digital shopping behaviors and exceptional receptiveness to international retailers. The market's trilingual nature (Dutch, French, and German) presents natural advantages for Dutch retailers, who can capitalize on linguistic similarities to tap into the German-speaking segments.

The Bpost group's global expansion has further strengthened this corridor, with infrastructure investments supporting efficient cross-border operations. Dutch retailers partnering with established logistics providers can achieve 70% satisfaction with home delivery preferences while meeting Belgium's growing sustainability expectations. 66% of consumers already recycle packaging, and 55% are willing to delay delivery for environmental benefits.

Product choice and brand variety drive 46% of cross-border purchases in Belgium, followed by fast delivery speed at 39% and easy product discovery at 36%. The dominance of clothing and footwear (37% of cross-border purchases) and the growing demand for home and garden products (17%) create natural opportunities for Dutch fashion, lifestyle, and home goods retailers.

European Markets

Germany: The Reliability-Focused Market (€88.8 billion)

Germany's market presents unique opportunities for Dutch retailers who understand German consumer priorities. With 62.4 million online shoppers and product choice driving 40% of cross-border purchases, German consumers prioritize reliable delivery (36%) over speed (31%), creating opportunities for Dutch retailers who can demonstrate dependability. The growing importance of home and garden products (22%) alongside the dominance of clothing (43%) indicates opportunities for category diversification.

France: The Premium-Focused Market (€175.3 billion)

France's market demonstrates clear trends toward higher-value purchases and sophisticated consumer behavior. With 47% of cross-border orders exceeding €50 and clothing dominating at 42% of international purchases, French consumers reward retailers offering premium positioning with authentic value propositions. Mobile adoption continues to grow at a rate of 42% of purchases, while sustainability consciousness creates differentiation opportunities for environmentally focused Dutch brands.

United Kingdom: The Mobile-First Premium Market (€306 billion)

Despite Brexit complexities, the UK remains Europe's largest e-commerce market with 53 million shoppers. British consumers increasingly prioritize product choice and brand variety (42%) over pure price considerations (32%), creating opportunities for Dutch retailers offering unique or specialized products. The mobile-first trend, with 46% of cross-border purchases via smartphone, demands optimized mobile experiences.

The US Market: Transatlantic Opportunity

The US market represents the largest absolute opportunity at $1.19 trillion. American consumers' focus on fast delivery (37%), low prices (33%), and product variety (33%) creates competitive dynamics that favor efficient operations and distinctive value propositions. Mobile dominance, at 53% of purchases, and fashion leadership, at 49% of cross-border purchases, create opportunities for Dutch lifestyle and specialty brands to enter the market.

Strategic Success Factors

Successful Dutch e-commerce expansion requires understanding both universal trends and local nuances. Mobile optimization emerges as crucial across all markets, with smartphone usage ranging from 42% in France to 53% in the US and Germany, while sustainability initiatives increasingly differentiate brands in environmentally conscious European markets. The consistent importance of product choice across markets, from 33% in the US to 46% in Belgium, validates Dutch retailers' focus on distinctive, high-quality offerings.

Payment localization, delivery transparency, and robust return processes have emerged as universal requirements, while specific preferences, such as Germany's emphasis on reliability or France's premium positioning, create targeted opportunities. The integration of optimizing parcel delivery to Germany through sustainable solutions reflects broader European trends toward environmental responsibility.

Summary

The Netherlands' strategic position as an e-commerce export hub presents unprecedented opportunities for international growth across six markets worth a combined €1.7 trillion. Success requires understanding each market's distinct characteristics, from Belgium's cross-border receptiveness and Germany's reliability focus to France's premium positioning and the UK's mobile-first expectations, while leveraging Dutch competitive advantages in logistics, sustainability, and quality.

The special Netherlands-Belgium corridor, strengthened by decades of Bpost partnership, provides an ideal testing ground for international expansion strategies. Dutch retailers who master this adjacent market can apply learned expertise to larger European markets and eventually the massive US opportunity.

Cross-border penetration rates ranging from Belgium's 32% to the UK's 9% indicate varying market receptiveness, while mobile adoption exceeding 42% across all markets demands sophisticated digital strategies. The consistent emphasis on product choice, delivery transparency, and sustainability across markets validates Dutch retailers' focus on quality, innovation, and environmental responsibility.

Ready to scale your Dutch e-commerce business internationally? Partner with Landmark Global. We understand diverse market requirements and can help you deliver exceptional customer experiences across borders.

You may also read:

Sources:

- Digital Commerce 360

- E-commerce in Europe 2021 (Postnord)

- eMarketer

- Euromonitor

- Europe E-commerce Region Report 2023 – RetailX

- European E-Commerce Report 2024 – Ecommerce Europe / EuroCommerce

- FEVAD

- IPC Cross-border E-commerce Shopper Survey 2022 – Spain Report

- IPC Cross-border E-commerce Shopper Survey 2023 - UK Report

- IPC Cross-border E-commerce Shopper Survey 2024 – Belgium Report

- IPC Cross-border E-commerce Shopper Survey 2024 – France Report

- IPC Cross-border E-commerce Shopper Survey 2024 – US Report

- Statista

- US Census Bureau